Cracks emerge in US jobs market as Fed officials sound warning

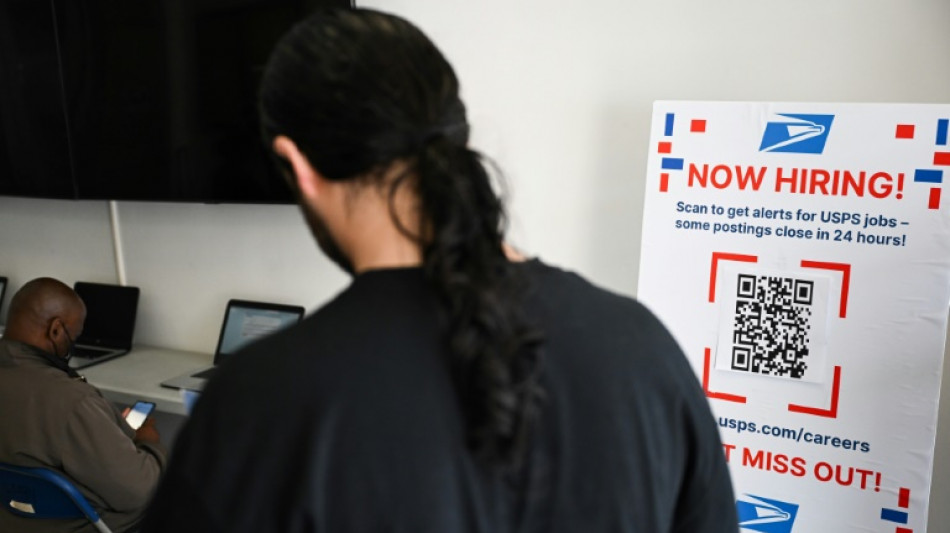

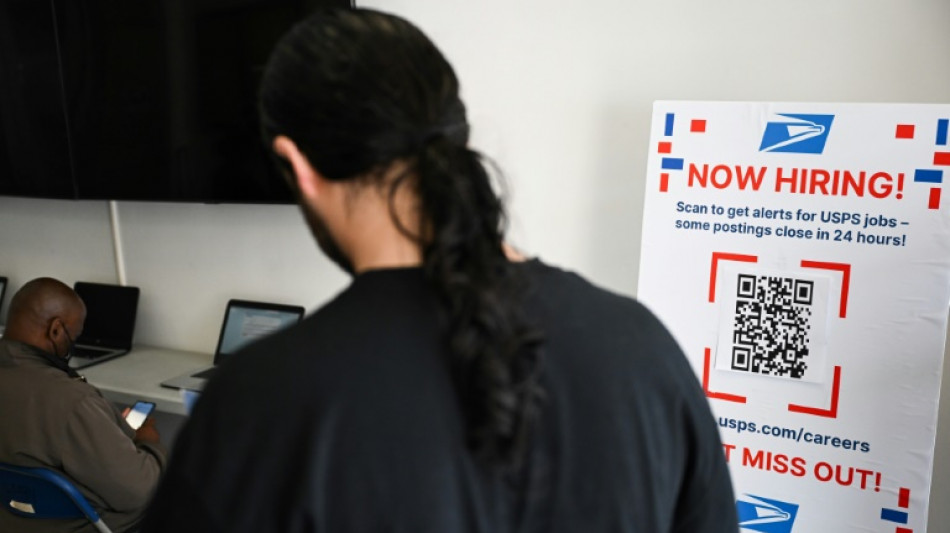

The US employment market is showing weakness as companies grappled with President Donald Trump's sweeping tariffs, government data showed Friday, while two central bank officials warned on labor risks in the world's biggest economy.

US job growth missed expectations in July, the data showed, and revisions to hiring figures in recent months brought them to the weakest levels since the Covid-19 pandemic.

The employment data points to cracks in the key jobs market as companies took a cautious approach in hiring and investment and puts pressure on the central bank as it mulls the best time to cut interest rates.

The world's biggest economy added 73,000 jobs last month, while hiring numbers were revised significantly lower for May and June, the Labor Department said.

The jobless rate nudged up from 4.1 percent to 4.2 percent.

Experts have warned that private sector firms appear to be in a wait-and-see mode due to heightened uncertainty over Trump's rapidly changing trade policy.

With tariff levels climbing since the start of the year, both on imports from various countries and on sector-specific products such as steel, aluminum and autos, many firms have faced higher business costs.

Some are now passing them along partially to consumers.

On Friday, the Department of Labor said hiring numbers for May were revised down from 144,000 to 19,000. The figure for June was shifted from 147,000 to 14,000.

This was notably lower than job creation levels in recent years. During the pandemic, the economy lost jobs.

Average hourly learnings rose by 0.3 percent to $36.44 in July, the Labor Department said.

It added that employment continued rising in health care and in social assistance, while the federal government continued shedding jobs.

- 'Gamechanger' -

"This is a gamechanger jobs report. The labor market is deteriorating quickly," said Heather Long, chief economist at the Navy Federal Credit Union.

She added in a note that of the growth in July, "75 percent of those jobs were in one sector: healthcare."

The US economy has added an average of just 35,000 jobs per month since May, data showed.

"The economy needs certainty soon on tariffs," Long said. "The longer this tariff whiplash lasts, the more likely this weak hiring environment turns into layoffs."

But it remains unclear when the dust will settle, with Trump ordering the reimposition of steeper tariffs on scores of economies late Thursday that are set to take effect in a week.

Trump also raised tariffs on Canadian imports, while maintaining existing exemptions.

Joel Kan, chief economist at the Mortgage Bankers Association, said that for now, "goods-producing industries saw contraction for the third straight month."

"Service industries involved in trade also saw declines in job growth, potentially a result of the uncertain tariff environment, as businesses either put their activity on pause or pulled back altogether," Kan added in a note.

- 'Overly cautious' -

A sharp weakening in the labor market could push the Federal Reserve toward slashing interest rates sooner to shore up the economy.

On Friday, the two Fed officials who voted this week against the central bank's decision to keep rates unchanged warned that standing pat risks further damaging the economy.

Both Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller argued that the inflationary effects of tariffs were temporary.

They added in separate statements that the bank should focus on fortifying the economy to avert further weakening in the labor market.

Putting off an interest rate cut "could result in a deterioration in the labor market and a further slowing in economic growth," Bowman added.

Waller said: "I believe that the wait and see approach is overly cautious."

O. Henrique--JDB

London

London

Manchester

Manchester

Glasgow

Glasgow

Dublin

Dublin

Belfast

Belfast

Washington

Washington

Denver

Denver

Atlanta

Atlanta

Dallas

Dallas

Houston Texas

Houston Texas

New Orleans

New Orleans

El Paso

El Paso

Phoenix

Phoenix

Los Angeles

Los Angeles